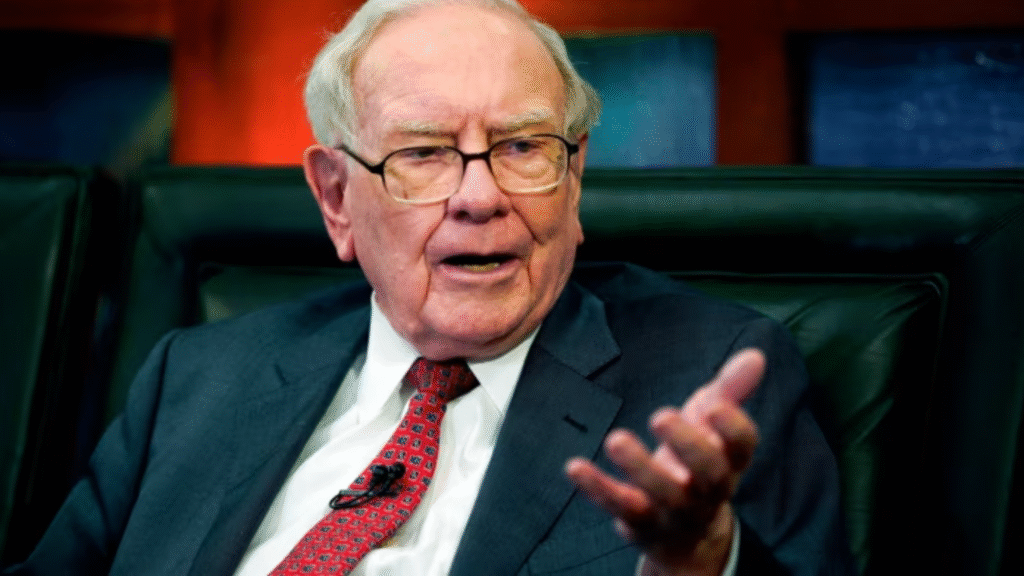

Investor Warren Buffett announced on Saturday that he will step down as CEO of Berkshire Hathaway at the end of the year, ending a remarkable 60-year tenure leading one of the most successful conglomerates in history.

Speaking at the annual Berkshire Hathaway shareholders meeting in Omaha, Nebraska, the 94-year-old billionaire said he will recommend that longtime executive Greg Abel take over the role. Abel currently oversees all of Berkshire’s non-insurance operations and has long been identified as Buffett’s successor.

“I think the time has arrived where Greg should become the Chief Executive Officer of the company at year end,” Buffett said.

Warren Buffett, still in good health but now walking with a cane, shortened this year’s traditional question-and-answer session, sparking speculation about the timing of his announcement that he’ll step down. Despite previously vowing to stay on the job until death or incapacitation, Buffett’s decision marks a major transition for the company and its shareholders.

Warren Buffett, 95, to step down as CEO of vast business EMPIRE

— RT (@RT_com) May 3, 2025

World’s 5th richest man (worth $155 BILLION) headed Berkshire Hathaway for almost 70 yrs

Buffett pledged to give away 99% of his fortune to charity

Gets standing ovation from shareholders pic.twitter.com/dVY2jIpKhx

Abel, who joined Berkshire in 2000 through the acquisition of MidAmerican Energy (now Berkshire Hathaway Energy), has steadily climbed the ranks and earned Buffett’s trust.

For years, shareholders assumed he would only take over in the event of Buffett’s death, but Saturday’s announcement made the succession timeline official.

During the meeting, Buffett also addressed U.S. trade policy and issued a thinly veiled critique of President Donald Trump’s approach to tariffs. He argued that using trade as a weapon damages America’s global standing and long-term prosperity.

“It’s a big mistake, in my view, when you have 7.5 billion people who don’t like you very well, and you have 300 million who are crowing about how they have done,” Buffett said.

He emphasized the importance of mutual trade benefits, stating, “We should be looking to trade with the rest of the world. We should do what we do best and they should do what they do best.”

Buffett also fielded questions about Berkshire’s massive cash reserves, which have grown to $347.7 billion. He explained that while the company is always on the lookout for deals, current market conditions have made attractive opportunities scarce.

“We just don’t see many things we understand that are attractively priced,” Buffett said, while adding that he believes opportunities will eventually emerge that justify holding so much cash.

This year’s shareholder meeting drew around 40,000 attendees, including notable figures like Hillary Clinton. Buffett had supported Clinton during her 2016 presidential run, though he has since avoided political endorsements to prevent affecting Berkshire’s business interests.

One dedicated attendee, Haibo Liu, traveled from China and camped overnight to be first in line, saying, “He has helped me a lot. I really want to express my thanks to him.”

Liu added that with Buffett stepping down, he felt a sense of urgency to attend: “I worry this could be the last meeting for him.”

Buffett closed his remarks with a dose of his usual wit and optimism.

“If I were being born today, I would just keep negotiating in the womb until they said, ‘You could be in the United States,’” he said, expressing continued faith in the American system despite its challenges.